How to set up a budget…Make Your Budget

Today is the day we set up your budget. This is the 4th step in the how to set up a budget series. You’ve done a great job so far and today is the day we make your realistic budget. A budget you can actually stick with.

If you have been following along and getting your budget done, good for you, I knew you could do it.

If you missed a post here’s what’s been covered so far. The importance of a budget, determine your monthly bills, gather spending receipts, and determine your monthly spending.

Now, that you have all of your bills totaled up for each month and know what your bills are. And you know what you are spending for groceries and other items per month, you can write up your budget.

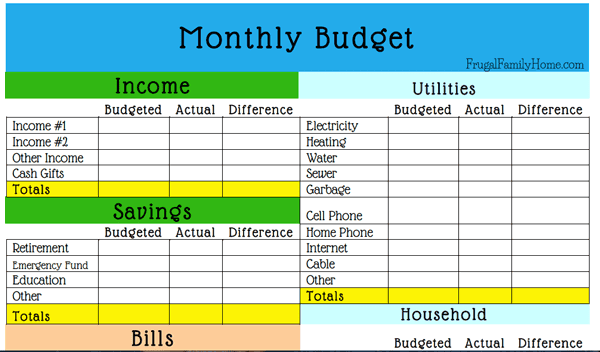

Step 1. Start with Your Income

First, you want to start with how much you have in income. At the top of any paper you have. This page doesn’t have to be fancy just the nearest sheet of paper will do.

If you want something a little fancier, grab a copy of this one page printable budget sheet. Remember to list all the income you have coming in that month not just your paycheck.

Step 2. Total Your Income

Second, Total all your income. This is what you will live on for the month. And if this amounts turns out to be more than your bills and spending, you are in good shape.

Step 3. List Your Bills

Next, list all your bills, include your bills that only come every other month or every three months, but make sure just to include the amount needed for 1 month of payment and not the whole two or three months.

You should have determined the amount needed for each bill, back in part 1 of this series. Do the same for all your bills that come less frequently.

You may want a ledger to keep track of how much you are leaving in your checking to save towards your every other month bills and less frequent bills.

I have ledger sheets that I set up for each item I’m saving for each month. The money goes into our savings account. But I keep a ledger to track how much we’ve saved towards each bill.

It’s an easy way to save for certain items without having separate saving accounts.

If you want to track your spending and income on the computer. This spreadsheet can help to track your bills for the whole year in one spreadsheet. Get the spreadsheet I use here.

Step 4. List Your Household Spending

Then, list all your other spending you do in a month such as groceries, out to eat and anything else you total up when you went through your receipts for the month. (You did this in Part 3 of the budget series)

Step 5. Calculate Your Budget

Add your bills and your spending totals and then subtract them from your income total.

If you have a negative number, meaning you have more spending than income, you will need to cut your spending to balance it out. You want to make sure your total spend is less than your income.

If you are spending more than you make, then every month you are going deeper into debt. Which is kinda like being a slave to your money. Who wants that?

If you have a surplus, more income than you spend, saving it is a good option. I would recommend saving it towards an emergency/rainy day fund.

I know some financial experts say to keep $1000 on hand in an emergency fund. Once you have a good cushion in your emergency fund, then you can apply any surplus to paying off your debt.

How We Track Our Money

Just in case you want to know how we track our money, I thought I’d share our process. We use a paper ledger to track savings towards bills and a spreadsheet too. Here’s how we budget…

The day we deposit the money for the month into the account. I add the proper amounts to each category that we have budgeted for that month in my budget ledger book. It’s just a 3 ring binder with a page for each bill we have.

I do this because we have bills we pay once a year I save for. And we have regular bills that only come once every 2 or 3 months.

And I don’t want to be caught without having enough for each bill so I keep a ledger to track what money goes to what bill.

And the money gets to sit in our savings account earning interest until we need it.

By having a budget book, I can track the amount we have towards each bill saved in the account.

Then when I pay the bill, I subtract it from my budget page. I do this for each bill as I pay it.

I also use a spreadsheet to track our spending and saving each month. So I can see from month to month. If we are spending more or less in a category and make adjustments.

Keeping a good budget means looking at if often and adjusting as needed. But we will talk more about this later in the series.

For everyday spending like groceries, gas, and anything we buy in person, we use cash. It’s easy to budget with cash, since once it’s gone, you have to quit spending.

That’s how we budget currently. It’s a little online, a little paper tracking and a cash envelope system all rolled together. But it’s what works for us.

You Did It, You Have Made a Realistic Budget

Congratulate yourself on sticking with this process and getting your budget done. Now comes the harder part sticking to it.

But you will have an advantage over others, you have made a realistic budget from the start. And so it will be easier to stick to.

The next in this series… Tips for sticking to your budget, you can find those tips here.

See all the post in this series by clicking here.

See all money related posts by clicking here.

I just made our June budget the other day. 🙂